Brexit Implications for High-End Real Estate Transactions in Spain

Brexit has undeniably unsimilar the landscape for British nationals looking to buy or sell property in Spain. With the transition period well overdue us, high-end real manor buyers must now navigate a post-Brexit world, where rules, regulations, and the market itself have shifted. Understanding these changes is crucial for anyone looking to invest in Spanish property.

The Impact of Brexit on Spanish Property Rights

First and foremost, it’s essential to understand that Brexit has not stripped British citizens of the right to buy property in Spain. Ownership rights remain intact; however, the process and implications of owning Spanish property now differ.

For Buyers: Adjusting to a New Set of Rules

If you’re considering a lavish villa in Marbella or a tony suite in Barcelona, Brexit ways uneaten homework. Previously, as EU citizens, British nationals enjoyed self-rule of movement, making the property purchase process relatively straightforward. Now, UK citizens are non-EU nationals and must comply with variegated visa requirements, potentially including limits on the time they can spend in their Spanish homes without a visa.

Residency and Visa Requirements

Post-Brexit, Brits can stay in Spain for up to 90 days within any 180-day period without a visa. To stay longer, you will need to wield for a visa, such as the non-lucrative visa or golden visa, the latter of which requires a significant investment in Spanish property but grants residency rights.

Tax Implications

The tax situation for British buyers has moreover changed. As non-EU citizens, they may squatter higher taxes in some instances. For example, rental income tax has increased from 19% to 24%, and the deduction of expenses is no longer an option.

For Sellers: Market Considerations and Tax Changes

If you’re looking to sell a high-end Spanish property post-Brexit, there are new considerations to take into account, primarily how Brexit has unauthentic market dynamics.

Market Shifts

The depreciation of the pound versus the euro pursuit Brexit may impact British sellers, as it affects the relative value of their resources in Spain. On the flip side, this currency shift may work in favor of those selling to buyers from the eurozone or other economies.

Capital Gains Tax

Capital gains tax for non-residents from outside the EU has risen to 24%, up from the 19% that EU citizens are charged. This could significantly impact the net proceeds from the sale of Spanish property for British nationals.

The Golden Visa: A Silver Lining

Spain’s Golden Visa program has emerged as a steer of opportunity for high-end real manor investors. By investing at least 500,000 in Spanish real estate, buyers from non-EU countries, including the UK post-Brexit, can obtain residency. This program is expressly well-flavored to those looking to spend increasingly than 90 days at a time in Spain, offering a path to permanent residency and plane citizenship.

Navigating the Transaction Process

High-end real manor transactions are ramified by nature, and with the widow layer of Brexit, it’s prudent to seek expert guidance.

Legal Representation

Hiring a local property lawyer, knowledgeable in the latest post-Brexit regulations, is essential. They can navigate the nuances of Spanish property law and ensure that all new legal requirements are met.

Financial Advisement

Consulting with a financial counselor who specializes in cross-border transactions can provide clarity on the tax implications and help optimize your investment in light of the new rules.

Patience and Preparedness

Transactions may now take longer due to spare bureaucratic hurdles. Buyers and sellers should be prepared for this extended timeline and ensure all their paperwork is in order, including NIE numbers (identification number for foreigners), proof of funds, and other necessary documentation.

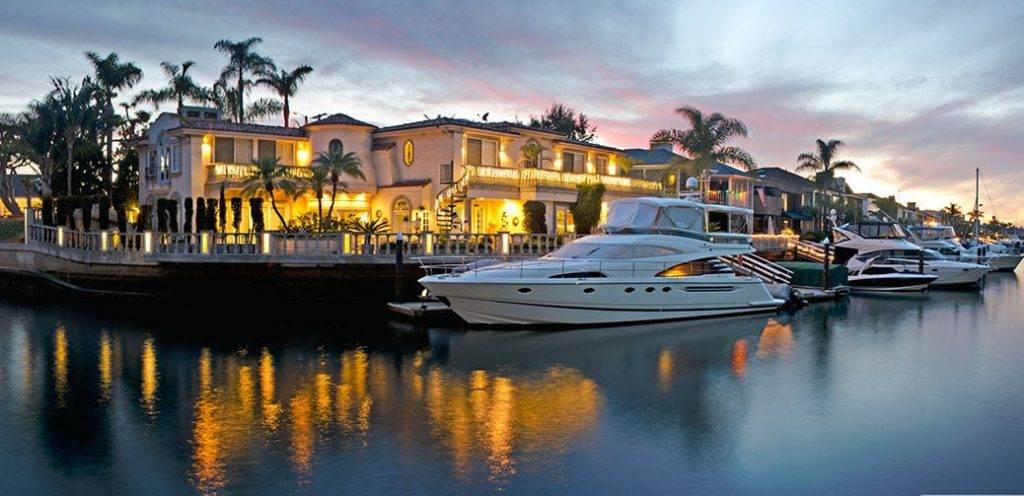

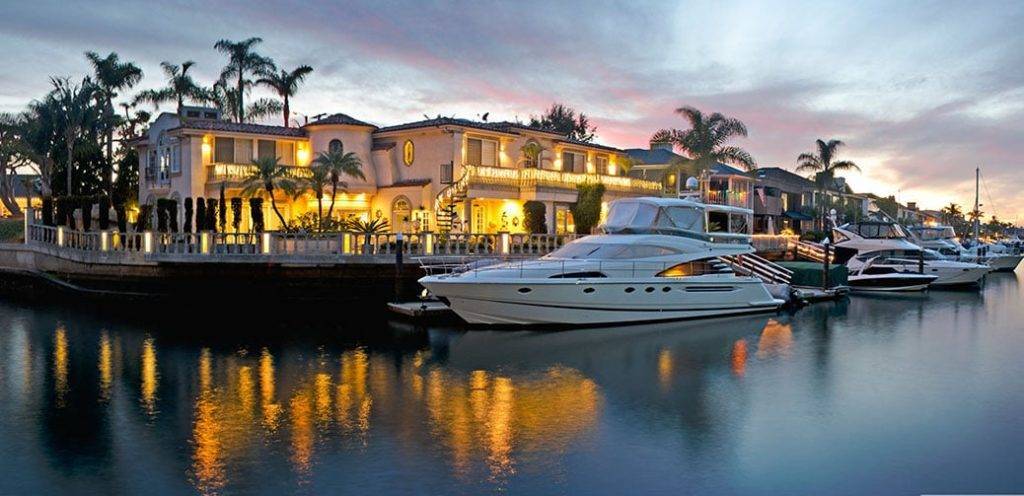

Looking Ahead: The Spanish Property Market Post-Brexit

Despite initial uncertainties, the Spanish property market has shown resilience. High-end properties, in particular, protract to vamp international buyers thanks to Spain’s favorable climate, lifestyle, and the inherent value of luxury real estate as a stable long-term investment.

Brexit has introduced new challenges but moreover opportunities for those willing to adapt. For instance, some British owners, deterred by the new regulations, may put their properties on the market, potentially increasing supply and creating opportunities for discerning buyers.

Conclusion

In a post-Brexit era, high-end real manor transactions in Spain between British nationals and Spaniards are underpinned by new rules and considerations. While the fundamentals of supply and demand remain unchanged, the tideway to ownership and selling must transmute to this new reality.

By remaining informed and seeking expert advice, high-end real manor investors can navigate these changes and protract to enjoy the benefits of Spanish property ownership. The voodoo of Spain’s real manor market endures, and with a strategic approach, it can protract to be a rewarding investment for British nationals post-Brexit.