Is Invested Capital Business Enterprise Value Plus Cash?

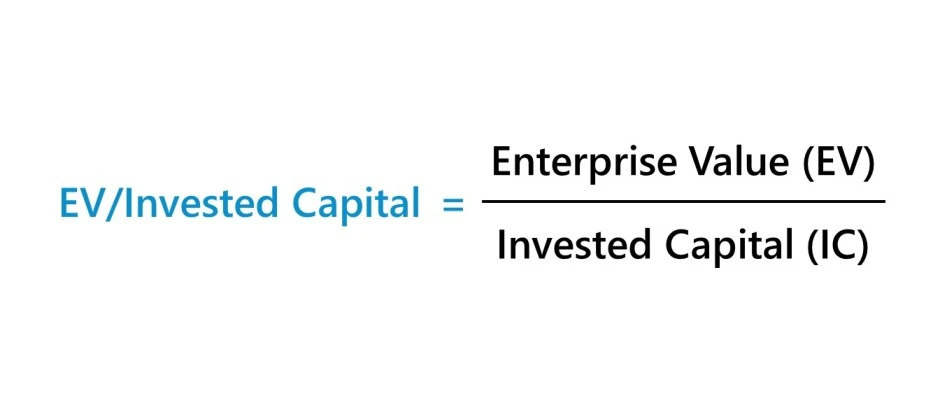

Overall Invested Capital (IC) of a business is one measurement of overall firm worth (like Enterprise worth). It indicates the worth of the core functions of the firm.

In addition, IC can alternatively be described as the mix of shareholder’s capital and paying interest debt. Although invested capital normally means the book value of the capital invested, the the price of invested capital is the money invested amount at market value.

What is Invested Capital?

MVIC (Market Value of Invested Capital) is the quantity of funding raised by selling shares to stakeholders and bondholders, and often comprises total debt and any funding lease commitments.

The Market Value of Invested Capital Equation

The Trade Value of Investment Capital (or MVIC) is equivalent to the markets price of the owners’ capital plus any long-term income carrying debt. Comparable to Enterprise Value, Market Value of invested money is a measure of total company value, representing the value of the key operations of a corporation.

What MVIC Means for Small Businesses?

MVIC is used commonly to estimate the value of small businesses, indicating the total cash employed in the company, comprising any physical assets and goodwill. In the case of owning a small business.

Read Also: Which Situation Best Reflects the Concept of Free Enterprise?

MVIC normally will not incorporate any advisory contract values, the worth of any business-owned real estate, or any dependent portion of the acquisition price (such as an earnout payment).

It nevertheless includes the value of any non-compete arrangements with the exiting management team, and may include the value of any present assets that are transferred to the buyer.

Is Invested Capital Business Enterprise Value Plus Cash?

Net income is the average profit premise utilized in proficient business appraisers. To keep things intriguing, the net income, or NCF for short, changes based upon whether you esteem the organization to decide its value worth or business venture esteem.

Why Net Income?

For what reason carry on with work appraisers utilize net income? To begin with, NCF is what financial backers are by and large later: cash from the business they can stash for themselves. Proprietors can partake in that unique excursion or spring for their next large yacht. Banks get compensated for the advances they make accessible to effective organizations. Everyone gets their portion.

Net income is omnipresent to such an extent that most expert business evaluation assets use it as a true standard while sorting out the rebate rate. So assuming you develop your rebate rate utilizing the standard expense of capital models, net income is the profit premise that squeezes squarely into your business evaluation. As the idiom goes, be consistent.

What Is Enterprise Value (EV)?

Enterprise value (EV) gauges an organization's all-out esteem. Its estimation incorporates the market capitalization of an organization as well as present moment and long-haul obligations, as well as any money or money reciprocals on the organization's monetary record. It is in many cases utilized as a more far-reaching choice to showcase capitalization while esteeming an organization.

Read Also: What Is Enterprise Architecture? A Framework for Transformation

Enterprise value (EV) gauges an organization's all-out esteem, frequently utilized as a more thorough option in contrast to value market capitalization. EV is determined utilizing data from an organization's fiscal summary.

Venture esteem considers the market capitalization of an organization, as well as present moment and long-haul obligations and any money on the organization's monetary record. Endeavor esteem is utilized as the reason for the overwhelming majority monetary proportions that action an organization's exhibition.

How Enterprise Value (EV) Works?

Enterprise value (EV) contrasts essentially from straightforward market capitalization in more than one way, and many believe it to be a more precise portrayal of a company's worth. EV tells financial backers or closely involved individuals what an organization's worth is and how much one more organization would require to buy it.

An organization's EV can be negative assuming the all-out worth of its endlessly cash reciprocals outperforms that of the consolidated all-out of its market cap and obligations.

This is an indication that an organization isn't utilizing its resources well; indeed, it has a lot of money lounging around not being utilized. Additional money can be utilized for some things, for example, appropriations, buybacks, extensions, innovative work, support, representative increases in salary, rewards, or taking care of obligations.

Formula and Calculation

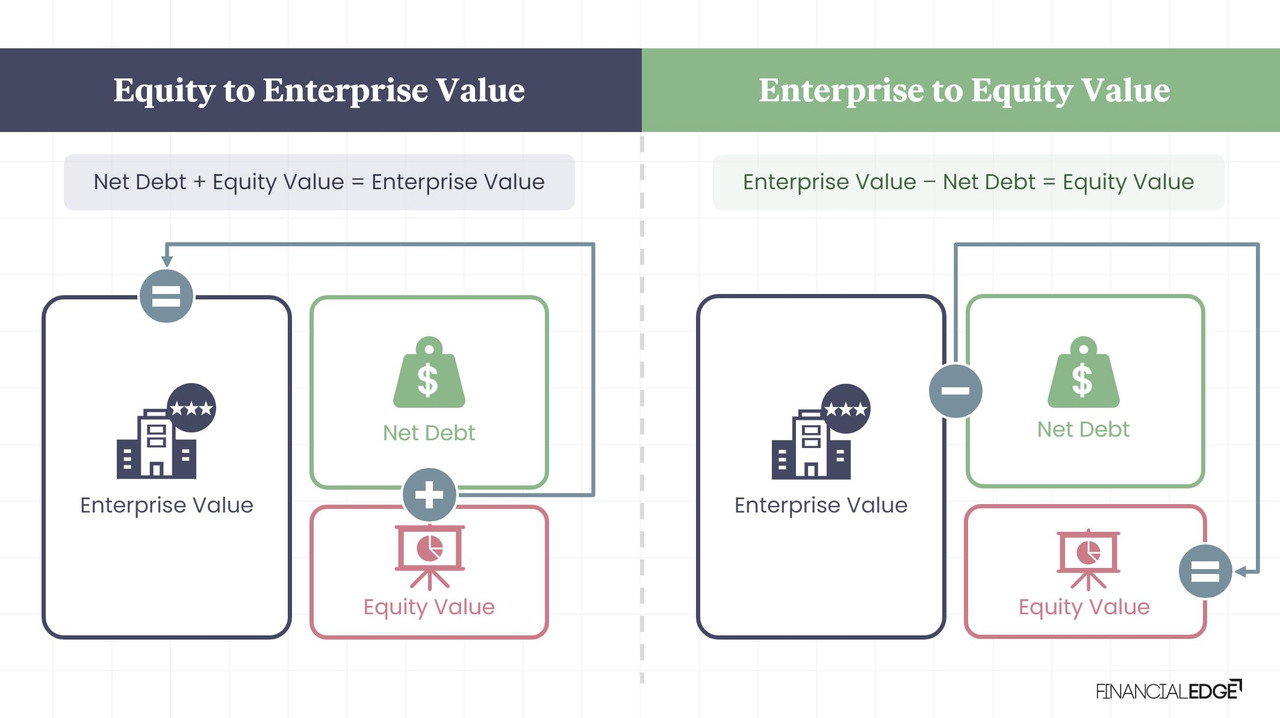

Enterprise value is the amount of an organization's market capitalization and any obligations, less money or money reciprocals close by. EV=MC+Total Debt−C. To compute market capitalization while perhaps not promptly accessible on the web, you would increase the quantity of remarkable offers by the ongoing stock cost.

Then, complete all obligations on the organization's monetary record, including both present-moment and long-haul obligations. At last, add the market capitalization to the absolute obligation and deduct any endlessly cash reciprocals from the outcome.

Financial Ratios That Use Enterprise Value

Enterprise value is utilized as the reason for the majority of monetary proportions that affect the presentation of an organization. For instance, the venture different contains undertaking esteem. It relates the complete worth of an organization from all sources to the income before interest, duties, devaluation, and amortization (EBITDA).

EBITDA estimates an organization's capacity to create income and is utilized as an option in contrast to straightforward profit or net gain in certain conditions. It is generally certain in any event when profit per share (EPS) isn't. Is Invested Capital business enterprise value plus cash?

EBITDA, nonetheless, can be delusional in light of the fact that it strips out the expense of capital ventures like property, plants, and gear. Another figure, EBIT, can be utilized as a comparative monetary measurement without the downside of eliminating deterioration and amortization costs connected with property, plant, and hardware (PP&E).

FAQ's- Is Invested Capital Business Enterprise Value Plus Cash?

Is Invested Capital Equal to Enterprise Value?

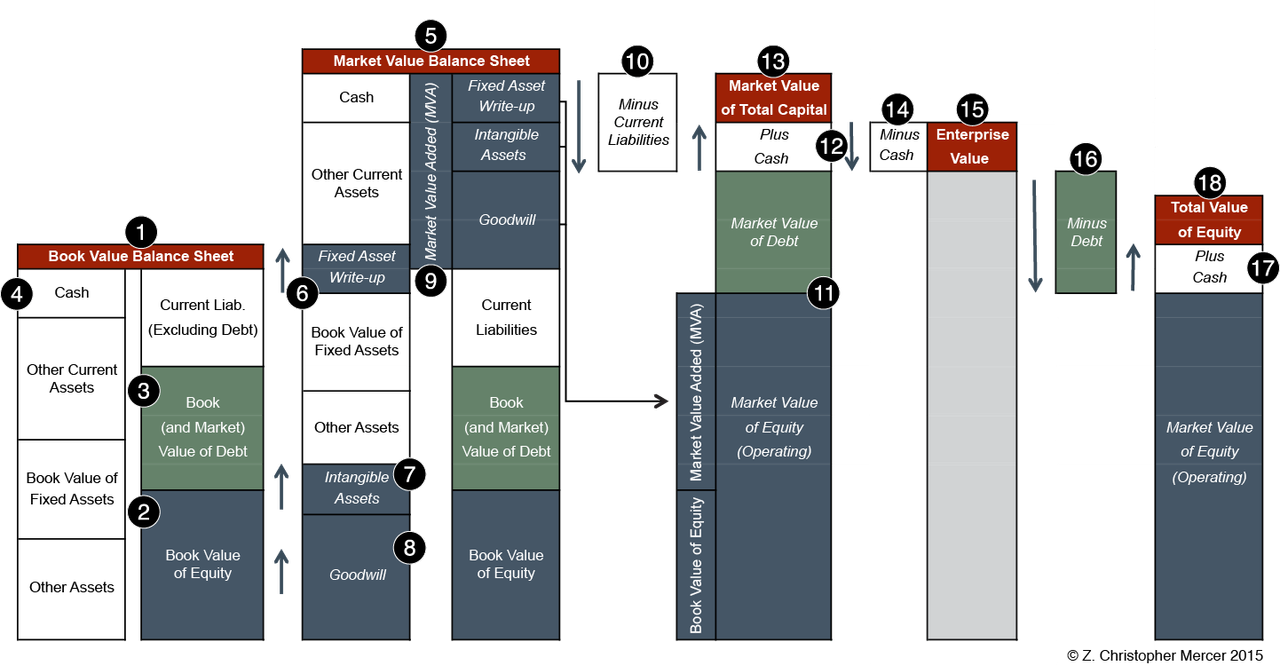

While both EV and MVIC are proportions of complete business esteem, both are viewed as 'capital design impartial', and both work with an overall worth investigation. However there are tremendous contrasts between the two. Set forth plainly, MVIC incorporates cash resources, while EV prohibits such resources.

Does Business Enterprise Value Include Cash?

Undertaking esteem (EV) gauges an organization's all out esteem. Its computation incorporates the market capitalization of an organization as well as present moment and long haul obligation, as well as any money or money counterparts on the organization's monetary record.

Why Do We Subtract Cash From Enterprise Value?

We take away this sum from EV since it will lessen the getting expenses of the objective organization. It is expected that the acquirer will utilize the money promptly to take care of a piece of the hypothetical takeover cost. In particular, taking care of a profit or purchase debt would be quickly utilized.

Is Cash Included in Business Valuation?

An organization valuation or business valuation is the act of working out an objective dollar an incentive for a business or concern. Specialists will inspect its resources and liabilities, incomes, profit, or different measurements to decide the organization's reasonable worth.

Why Is Cash Added to Equity Value?

Obligation and obligation counterparts, non-controlling interest, and favored stock are deducted as these things address the portion of different investors. Endlessly cash reciprocals are added as any money left subsequent to taking care of different investors are accessible to value investors.